7 Reasons Why Buying VS. Renting A Home in Dallas Texas Is Much Better.

Are you currently renting and wondering if buying a home in Dallas Texas is the right move for you? You’re not alone! The decision to buy a home is significant, but in a city like Dallas, it’s an opportunity you don’t want to miss. Here at The Richard Woodward Team NEXA Mortgage, we’re passionate about helping you make informed decisions. Let’s dive into seven financial reasons why buying a home in Dallas beats renting hands down. Let’s explore the Buying Vs. Renting question now.

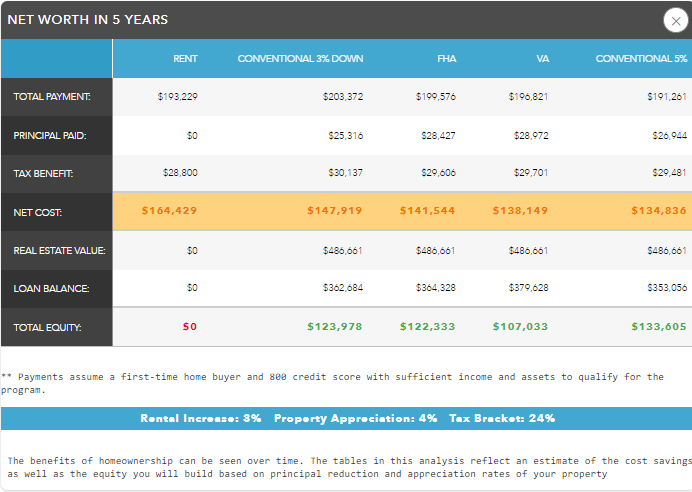

1. Building Equity: Your Investment in the Future Unlike paying rent, which feels like filling a bottomless pit, every mortgage payment is an investment in your future. With each payment, you’re building equity in your home – a valuable asset that grows over time. Think of it as a forced savings plan that pays off in the long run. Take a look at the number in this analysis.

If you were buying vs renting a $400,000 home today, at current rates, your net worth in 5 years is $123,978 greater than if you had been renting.

2. Predictable Monthly Payments Rent prices can be as unpredictable as Texas weather! The average rent increase in Dallas Texas for single family homes has been roughly 6% per year according RealWealth.com, but with a fixed-rate mortgage, you lock in your monthly principal and interest payment. This stability protects you from the annual rent hikes and gives you control over your housing budget.

3. Tax Benefits: Savings You Can’t Ignore Homeownership comes with attractive tax deductions. You can deduct mortgage interest, mortgage insurance, and property taxes, leading to significant savings during tax season. These benefits are exclusive to homeowners, giving you yet another financial edge over renting. By being able to deduct these expenses you reduce your tax burden and end up paying less taxes or getting a refund.

4. Appreciation: Watch Your Investment Grow Real estate in Dallas has shown consistent appreciation over the years. This means the home you buy today could be worth considerably more in the future. It’s not just a place to live; it’s a smart investment that appreciates over time. The long-term financial benefits of buying vs renting are significant. For example, if your home appreciates at a conservative rate of 4% per year, a $400,000 home today could be worth over $486,661 in five years.

5. Freedom to Personalize: Increase Your Home’s Value Owning a home means you can make it truly yours. Whether it’s a kitchen remodel or a fresh coat of paint, these improvements can increase your home’s value – something you can’t do with a rental.

6. Lower Overall Costs with The Richard Woodward Team At The Richard Woodward Team NEXA Mortgage, we pride ourselves on finding you the best rates and lowest fees. Our 220 approved lenders are competing for our loans- your loan- therefore you win with lower rates and fees than your bank or local mortgage banker. Our expertise means we can often make buying a home more affordable than renting in the long run. We’re here to ensure your mortgage plan is tailored to your financial needs.

7. A Sense of Community and Stability Owning a home in Dallas means being part of a community. It’s a sense of belonging and stability that renting just can’t match. Plus, you’re contributing to the local economy and laying down roots for your future. Having long term neighbors and neighborhood events is fun and relaxing.

Ready to Make the Leap from Renting to Owning? If these reasons have sparked your interest in buying vs renting a home in Dallas, The Richard Woodward Team at NEXA Mortgage is here to guide you every step of the way. We’re not just mortgage experts; we’re your partners in making your dream of homeownership a reality. Reach out to Richard today, and let’s explore how we can turn your renting expenses into a smart investment in your future.