Cash Home Buyers Can Cost Sellers Lots of Money

Cash buyers are supposed to be great for sellers right? That may not be true when it comes to Ebuyers. Why should home sellers be cautious when it comes to accepting offers form “cash buyers”? What is an Ebuyer? Ebuyers are home buyers like OpenDoor, OfferPad, Redfin, We Buy Ugly Houses and a whole litany of others. Selling your home can be a little scary and frustrating, especially when you have big companies spending millions of dollars telling you that licensed professional Realtors are not good for you.

First of all, lets look and the basics of home selling. I think we all agree that the ultimate goal is selling your home for as much as you possibly can. I think we can also agree that the more exposure your home has, the greater possibility you will have to attract the highest bid. Just think about this, if you only showed your home to one person or one company do you think you are going to get the best price? I think not.

Secondly, let’s look at the economics behind home buyers from the sellers perspective. Individual homebuyers that are going to purchase your home to live in are more likely to pay you top dollar for it. Homebuyers normally envision themselves living in the home, raising a family, or retiring peacefully there. They have an emotional as well as financial connection to your home. They are also competing with other homebuyers because smart sellers have listed their home with a professional Realtor that is marketing your home to millions of potential buyers. On the other hand, big company Ebuyers and individual investors are not going to live in your home. They have no connection to it other than a vehicle to make money. They want to buy the home to either rent it out or to resell it or “flip” it. In order for them to make money, they must be able to buy your home below it actual market value.

Ebuyers that are going to flip the home must buy it 20-40 percent below the true market value. They will try to convince you that your home is not worth as much as the other homes that have recently sold because they will have to “fix” it. That is completely understandable as they are in business to make money. But again, if your home is not being marketed by a professional Realtor, it is not being exposed to the millions of potential buyers that might want to pay you more.

I have personally been solicited by a couple of these Ebuyers. I purchased a home in a great neighborhood a little over 2 years ago. I began to receive letters in the mail with what they said was a “fair” offer. I had just purchased the home and had a recent appraisal of the value. This “fair” offer was $50,000 less than I had just paid for the home, but there was no commission to pay! Big deal, they still wanted to charge me a 7-9% FEE to do the paperwork and I could be asked to give them a credit for some minor repair issues. But they would pay cash and close quickly. Wow! Big deal! How was that a “fair” deal?

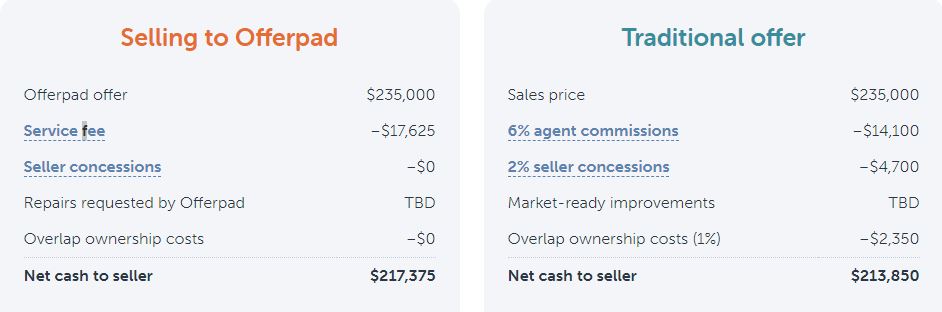

Take a look at this offer posted on one of the Ebuyers website.

I have been in the mortgage business for over 20 years. I have helped hundreds of homebuyers with their home purchase. This offer comparison is so misleading the Department of Consumer Affairs should review it. First of all, on the traditional offer, the 2% seller concession is highly inflated and is negotiable. In today’s market seller concessions are rare. Secondly, the overlap ownership cost? Really, what is that? There is no explanation of that fee on the website but the unsuspecting seller with no representation is likely to believe that is a real thing. It is also highly unlikely that this Ebuyer is going to pay the same as a regular home buyer when the seller uses a professional Realtor. Think about that, they are going to offer you the same as any regular home buyer? This is absurd. What is that Service Fee? Really, a 7.25% fee and the website indicates it could be as much as a 10% fee. Insane!

A better way!

Even if your home is in need of lots of repairs like foundation repair, a new roof, or just a remodel, a professional Realtor skilled in the Ready for Renovation Home Marketing Program will be able to sell your home for more money. You can do nothing to your home or you can make repairs to allow your home to sell for top dollar. Either way, you will not be taken advantage of by these Ebuyers. Yes, it will take more time to sell but for me, $50,000 would be worth several months of marketing time.

If you have been approached by one or more of these “Cash Buyers” or Ebuyers and would like a second opinion, call me at (214) 945-1066. I work with some of the best Realtors in town and I teach continuing education classes to Realtors about how to use the Ready for Renovation Home Marketing Program (Read Home Improvement Loans Give Realtors Advantages) for homes that need a little TLC. I want to put an end to this booming practice of taking advantage of sellers when they are at the most vulnerable in some cases. Let me help you sell for the most money.

If you would like a FREE Home Value Consultation with a highly trained Realtor Professional, please complete this form.

Richard Woodward, NMLS 217454

Your Local, Direct, 5 Star Rated Mortgage Lender, Specialty Lending Manager

Office: (214) 945-1066

mortgageprosus.com/5-star-reviews

Service First Mortgage NMLS 166487

6800 Weiskopf Ave #200, McKinney, TX 75070

Licensed by the Texas Department of Savings and Mortgage Lending (SML) Mortgage Banker Registration. Service First Mortgage is an Equal Housing Lender. This is not an offer of credit or commitment to lend. Loans are subject to buyer and property qualification. Rates and fees are subject to change without notice. The views expressed on this site are those of the individual author and do not necessarily reflect the positions, strategies or opinions of Service First Mortgage or its affiliates.