Divorcing Your Mortgage IRA Conversion

Divorcing Your Mortgage | Should Divorcing Clients Convert to a Roth IRA

One of the primary benefits of using a Roth IRA is that you don’t pay income tax when you withdraw funds in retirement. Unfortunately not everyone meets IRS standards to contribute to a Roth IRA. The primary reason individuals are not allowed to contribute is because their incomes exceed the Roth IRA income limits. That’s when it makes sense to look into a Roth IRA conversion.

What happens instead is that many individuals who do not qualify for income reasons end up investing in 401(k) plans and Traditional IRAs. With a Traditional IRA you receive a tax break today, but pay income taxes in retirement. This is opposite of what happens with a Roth IRA.

The IRS has always allowed certain individuals to convert their Traditional IRAs to Roth IRAs as long as they met specific qualifications and paid income tax on the conversion. But high-income earners were unable to convert until recently.

No Income Cap to Convert Traditional IRA to Roth IRA

In the past to be able to convert from a Traditional to a Roth IRA your income needed to be under $100,000. The IRS rules have changed and there is no longer an income cap in place.

With the cap removed, high-income earners can now convert as long as they pay the appropriate tax on the conversion. There is no 10% early withdrawal penalty if the funds move from a Traditional IRA to a Roth IRA in a 60-day window.

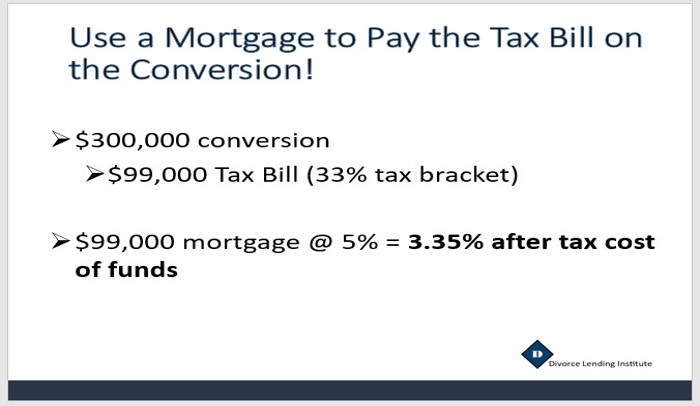

Using a Mortgage to Pay the Tax Bill on the Conversion

Assume that Clint and Terri are getting a divorce and they have a traditional IRA with a value of $300,000 which through the divorce settlement agreement is going directly to Terri. They are in a 33% tax bracket which would equate to a future tax liability of $99,000 for Terri. If Clint is retaining the marital home valued at $300,000 and Terri is getting the $300,000 IRA – there’s not an equitable division of assets if the future tax bill is not addressed.

Now assume that Clint wants to make sure that Terri does not have to be worried about a tax bill when she reaches retirement age and since he is working and able to afford it he wants to look at options to pay the conversion tax bill for Terri. A very smart option for Clint to find this $99,000 is to take it out of the equity in the marital home he is keeping rather than paying cash for the tax bill.

Now assume that Clint wants to make sure that Terri does not have to be worried about a tax bill when she reaches retirement age and since he is working and able to afford it he wants to look at options to pay the conversion tax bill for Terri. A very smart option for Clint to find this $99,000 is to take it out of the equity in the marital home he is keeping rather than paying cash for the tax bill.

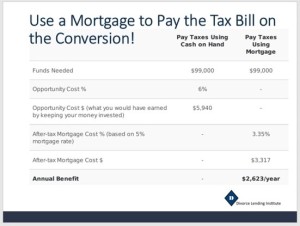

Let’s look at the financial advantage of using a mortgage to pay for the conversion. In this example, we are comparing the consequences of paying the tax bill with cash vs. paying the tax bill using a new mortgage. The amount of cash needed is $99,000 due to the 33% tax bracket. If Clint was to keep the $99,000 in his investment account earning a 6.5% return, he would lose

$6,435 per year in income in the investment account (Opportunity Cost).

When Clint takes out a new mortgage where he gets the $99,000 cash out of the equity in the home at an interest rate of 4.5%, his after tax mortgage cost is actually only 3.015%. This is because Clint is in a 33% tax bracket. The after tax mortgage rate is a simple calculation.

Regardless of how you calculate the after tax mortgage interest rate on $99,000 the after tax mortgage cost of borrowing the $99,000 is only $3,118 during the life time of the loan. This equates to an annual benefit of $3,317 per year and appears to be a very smart option for Clint to pay the tax bill for Terri.

As mentioned earlier, a ROTH IRA Conversion is a smart choice right now for anyone regardless of whether or not they are going through a divorce. A conversion benefits anyone who wants to convert some or all of their traditional retirement account funds into a Roth IRA while there are no limits to the amount you can convert.

Roth IRA Contribution Limits for New Accounts

How Much Can You Contribute to a ROTH IRA

How Much Can You Contribute to a ROTH IRA

Quick summary: If you are under 50, you may contribute up to $5,500 in 2017 and 2018. If you are 50 or over, you may contribute $6,500. The amount you can contribute is based on income limits, however.

The Internal Revenue Service limits contributions to all retirement accounts, including Roth IRAs.

The contribution limits for Roth IRAs de- scribed below are based on the assumption

that you qualify to contribute to a Roth under the IRS income limits.

Roth IRA Contribution Limits for Individuals Under 50

Individuals who are under 50 years old may contribute $5,500 to an IRA. This amount is the maximum you may deposit per year across all IRAs you may have with multiple providers, including both Traditional or Roth IRAs.

For example, you could contribute $2,500 to a Roth IRA with one provider and $3,000 with a second provider. You cannot contribute $5,500 to the first Roth IRA and $5,500 to the second provider. Your total contribution limit is $5,500 for all accounts for the tax year.

Roth IRA Contribution Limits for Individuals 50 or Older

For those age 50 or older, the same $5,500 contribution limit across all Roth IRAs is in place. However, the IRS also allows these individuals to also contribute an additional $1,000 as “catch up” contributions. Although this allowance is provided to assist individuals who are behind in retirement savings, it is available to everyone age 50 or over who qualifies for a Roth IRA.

Additional Roth IRA Contribution Information

Individuals may contribute money to a Roth IRA from January 1 of the current tax year to April 15 of the following tax year (in 2018, the date is April 17). Contributions are made with post-tax dollars. You pay tax today so that no tax is charged to you for withdrawals you make in retirement.

Please don’t hesitate to reach out to me if I can provide you and your divorcing clients with information on using a mortgage to help pay the conversion cost from their traditional IRA to a ROTH IRA!

Read more about Divorce and Your Mortgage and why you need a CDLP

Why You Need A Certified Divorce Lending Professional on Your Professional Divorce Team

A professional divorce team has a range of team players including the attorney, financial planner, accountant, appraiser, mediator and yes, a divorce lending professional. Every team member has a significant role ensuring the divorcing client is set to succeed post decree.

A Certified Divorce Lending Professional brings the financial knowledge and expertise of a solid understanding of the connection between Divorce and Family Law, IRS Tax Rules and mortgage financing strategies as they all relate to real estate and divorce. Having a CDLP® on your professional divorce team can provide you the benefit of:

- A CDLP is trained to recognize potential legal and tax implications with regards to mortgage financing in divorce situations.

- A CDLP is skilled in specific mortgage guidelines as they pertain to divorcing clients.

- A CDLP is able to identify potential concerns with support/maintenance structures that may conflict with mortgage financing opportunities.

- A CDLP is able to recommend financing strategies helping divorcing clients identify mortgage financing opportunities for retaining the marital home while helping to ensure the ability to achieve future financing for the departing spouse.

- A CDLP is qualified to work with divorce professionals in a collaborative setting.

- A CDLP can provide opportunities in restructuring a real estate portfolio to increase available cash flow when needed.

- A CDLP maintains a commitment to remaining educated and up to date in the ever changing industry guidelines and tax rules as they pertain to divorce situations.

- A CDLP is committed to providing a higher level of service to you and your divorcing clients.

The role of the CDLP is to help not only the divorcing client but the attorney and financial planner understand the opportunities available as well as the challenges divorce can bring to mortgage financing during and after the divorce. When the CDLP is involved during the divorce process and not after the fact, many potential financing struggles can be avoided with valuable and educated input from the Certified Divorce Lending Professional.

“Nothing matters more in winning than getting the right people on the field. All the clever strategies and advanced technologies in the world are nowhere near as effective without great people to put them to work.” – Jack Welch, Winning

Richard Woodward is a Certified Divorce Lending Professional

This is for informational purposes only and not for the purpose of providing legal or tax advice. You should contact an attorney or tax professional to obtain legal and tax advice. Interest rates and fees are estimates provided for informational purposes only, and are subject to market changes. This is not a commitment to lend. Rates change daily – call for current quotations.

Richard Woodward, NMLS 217454

Your Local, Direct, 5 Star Rated Mortgage Lender, Specialty Lending Manager

Office: (214) 945-1066

mortgageprosus.com/5-star-reviews

Service First Mortgage NMLS 166487

6800 Weiskopf Ave #200, McKinney, TX 75070

Licensed by the Texas Department of Savings and Mortgage Lending (SML) Mortgage Banker Registration. Service First Mortgage is an Equal Housing Lender. This is not an offer of credit or commitment to lend. Loans are subject to buyer and property qualification. Rates and fees are subject to change without notice. The views expressed on this site are those of the individual author and do not necessarily reflect the positions, strategies or opinions of Service First Mortgage or its affiliates.