The Cost of Renting vs. the Cost of Owning during a Divorce

The Cost of Renting vs. the Cost of Owning

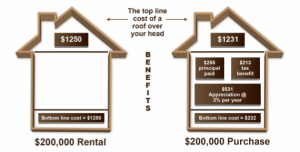

Many divorcing clients will make the decision to rent following a divorce for a variety of reasons; however, there’s more to the cost of renting vs. buying than just comparing the dollar cost of the payments. Many will argue against the value of purchasing a home vs. the comparatively risk free alternative of renting.

This image can be used for determining whether to rent or purchase a new home as well as the economical decision to sell the marital home and rent or retain the marital home.

To be conservative, we used a rate of appreciation here of only 3%; yet the national average over the last 50 years exceeds 5%. Some will also argue that the tax deductibility of mortgage interest and real estate taxes is never really worth it. What they really mean is that everyone has a base line standard deduction and not everyone’s total expenses will be more valuable than that. Even if you exclude the tax benefit, the bottom line difference vs. renting will still be better.

Factors used above: $200,000 purchase price, 20% down, $160,000 30 yr fixed at 4%. Principal & Interest payment = $763.86, taxes = $250/mo., insurance = $50/mo. & Maintenance = $166.67/mo. Tax deductibility at 28%. Tax savings principal paid and appreciation averaged over a 5 year period. Always consult with a tax advisor for tax advice specific to your situation.

We understand that sometimes following a divorce it may seem easier and simpler to just rent a new home – even if only temporary. Don’t hesitate to reach out at any time if you would like to run specific scenarios for renting vs. home ownership.

It is always important to work with an experienced mortgage professional who specializes in working with divorcing clients. A Certified Divorce Lending Professional (CDLP) can help answer questions and provide excellent advice. For more information about Divorce Lending visit our blog posts and website pages.

It is always important to work with an experienced mortgage professional who specializes in working with divorcing clients. A Certified Divorce Lending Professional (CDLP) can help answer questions and provide excellent advice. For more information about Divorce Lending visit our blog posts and website pages.

Richard Woodward, NMLS 217454

Your Local, Direct, 5 Star Rated Mortgage Lender, Specialty Lending Manager

Office: (214) 945-1066

mortgageprosus.com/5-star-reviews

Service First Mortgage NMLS 166487

6800 Weiskopf Ave #200, McKinney, TX 75070

Licensed by the Texas Department of Savings and Mortgage Lending (SML) Mortgage Banker Registration. Service First Mortgage is an Equal Housing Lender. This is not an offer of credit or commitment to lend. Loans are subject to buyer and property qualification. Rates and fees are subject to change without notice. The views expressed on this site are those of the individual author and do not necessarily reflect the positions, strategies or opinions of Service First Mortgage or its affiliates.

This is for informational purposes only and not for the purpose of providing legal or tax advice. You should contact an attorney or tax professional to obtain legal and tax advice. Interest rates and fees are estimates provided for informational purposes only, and are subject to market changes. This is not a commitment to lend. Rates change daily – call for current quotations.